Your ads will be inserted here by

Easy Plugin for AdSense.

Please go to the plugin admin page to

Paste your ad code OR

Suppress this ad slot.

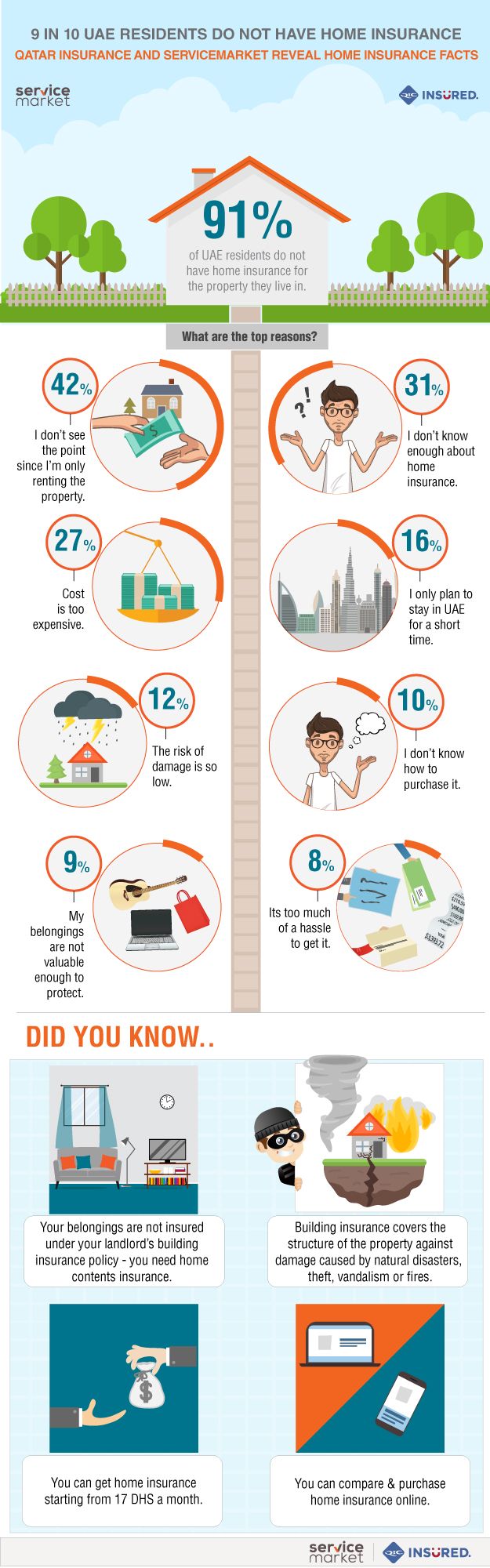

The latest survey conducted by ServiceMarket and Qatar Insurance shows that 91% of UAE residents do not have home insurance! ServiceMarket, the UAE’s largest online marketplace for home services, and Qatar Insurance, a global multi-line insurer, recently published a report and infographic highlighting key findings on home insurance habits in the UAE. The study surveyed over 1500 UAE residents through an online survey to find out their habits and views about home insurance.

So what are the key drivers for purchasing home insurance?

Amongst those who had home insurance, the top reason for purchasing it was for peace of mind (44%), while over a quarter (26%) purchased home insurance because it was mandatory. Frederik Bisbjerg, Head of Group Retail & Executive Vice President MENA in Qatar Insurance Company, explained that, “In the UAE, home insurance is mandatory in certain cases, for example, you are required by the bank to have home insurance if your home is being mortgaged.”

It appears that news reports of events such as a fire or theft are also key drivers for people to purchase home insurance. Over a fifth (21%) of those who had purchased home insurance stated that they purchased home insurance after seeing an event on the news. On this point, Bana Shomali, CEO & Co-founder of ServiceMarket, commented, “We always notice a significant increase in the number of people who are looking for home insurance after a key event such as a fire. After the recent fire in Sulafa Tower in the Marina, we noticed around a 200% increase in the number of people expressing interest in purchasing home insurance.”

And why do most people not have home insurance?

The top reason for not having home insurance was that respondents (42%) didn’t see the point since they are only renting the property. The majority of UAE residents rent their homes, rather than purchase them and it appears that this makes home insurance less appealing or unnecessary in the minds of many respondents, despite the fact that their belongings would not be covered under their landlord’s building insurance policy.

Your ads will be inserted here by

Easy Plugin for AdSense.

Please go to the plugin admin page to

Paste your ad code OR

Suppress this ad slot.

On this point, Frederik commented, “Home insurance has serious benefits to both homeowners and tenants. Even if you do not own the property you are living in, purchasing home contents insurance protects your own belongings against damages caused by events such as a flood, fire or theft. Your personal belongings, such as your furniture and electronics, would not be covered under your landlord’s insurance policy. You may not consider your belongings to be valuable, however replacing them after such an event would cost thousands, and you could potentially need to pay for replacement accommodation. Furthermore, home insurance protects you against accidental damage to the property and any liability to your landlord.”

It appears that there is a general lack of knowledge about home insurance in the market, with almost a third (31%) stating that they do not know enough about home insurance. Over a quarter (27%) of respondents who do not have insurance believe that home insurance is too expensive, however, you can get home insurance from as little as 17 Dhs a month in the UAE.

Top 5 reasons for not buying home insurance:

- I don’t see the point since I am only renting the property (42%)

- I don’t know enough about home insurance (31%)

- The cost of home insurance is too expensive (27%)

- I only plan to stay in the UAE for a short time (16%)

- The risk of damage is so low (12%)

What you should know about home insurance:

If you are a tenant:

You should have home contents and personal possessions insurance, as your belongings would not be covered under your landlord’s building insurance policy. Home contents insurance covers items inside the house such as furniture and your electronics in case of an event such as a flood, fire or vandalism. Personal possessions insurance covers your items when you take them outside of your home in case of loss, damage or theft. Personal possessions can include items such as your phone, laptop, jewellery and handbags. You can also get cover to protect you against accidental damage and any liability to the landlord.

If you are a homeowner:

If you own a property then you should have building insurance. This covers the structure of the property against damage caused by natural disasters, theft, vandalism or fires. If you are renting the property, then this insurance would offer protection against any damages made to the property by the tenant. On the other hand, if you are living in the property yourself, you should also take out home contents and personal possessions insurance to protect your belongings.

Rafomac Rafomac.com is a Personal Blog towards my knowledge in IT and related things

Rafomac Rafomac.com is a Personal Blog towards my knowledge in IT and related things